Apple Promotes New Apple Pay UK Bank Account Balance Feature

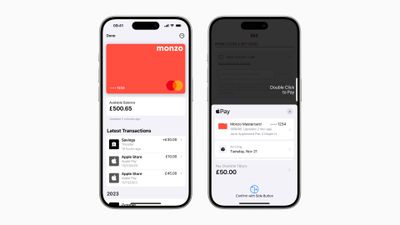

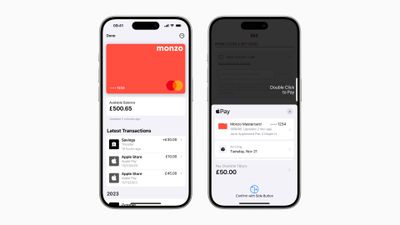

Apple today highlighted the ability in iOS 17.1 for UK users to connect their credit and debit cards in Apple Wallet and easily access information like account balance, spending history, and more.

Users can view their up-to-date bank card balance, payments, deposits, and withdrawals in Wallet and when they're checking out with Apple Pay online or in-apps. Apple says the new feature "empowers users to make more informed purchases, increases their confidence when making a transaction, and allows them to simply view frequent information so that they have more control when it comes to their finances."

From Apple's press release:

"By enabling users to conveniently access their most useful account information within Wallet and at the time of their purchase, they can make informed financial decisions and better understand and manage their spend," said Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet. "We look forward to working with U.K. partners under the Open Banking initiative to help users better their financial health, and provide more ways in which banks can deepen their relationships with customers."

Apple added the transaction and card balance functionality to the Wallet app in October's iOS 17.1 update as part of its Connected Cards feature, and several banks have since come on board, including Barclays, Barclaycard, First Direct, Halifax, HSBC, Lloyds, M&S Bank, Monzo Bank, NatWest Bank, and Royal Bank of Scotland.

UK banks support the Open Banking API to integrate with the Wallet app, which has made the feature widely available to UK users, while the Connected Cards rollout in the United States has lagged behind.

Popular Stories

Last year, Apple launched CarPlay Ultra, the long-awaited next-generation version of its CarPlay software system for vehicles. Nearly nine months later, CarPlay Ultra is still limited to Aston Martin's latest luxury vehicles, but that should change fairly soon.

In May 2025, Apple said many other vehicle brands planned to offer CarPlay Ultra, including Hyundai, Kia, and Genesis.

In his Powe...

Apple today confirmed to Reuters that it has acquired Q.ai, an Israeli startup that is working on artificial intelligence technology for audio.

Apple paid close to $2 billion for Q.ai, according to sources cited by the Financial Times. That would make this Apple's second-biggest acquisition ever, after it paid $3 billion for the popular headphone and audio brand Beats in 2014.

Q.ai has...

The calendar has turned to February, and a new report indicates that Apple's next product launch is "imminent," in the form of new MacBook Pro models.

"All signs point to an imminent launch of next-generation MacBook Pros that retain the current form factor but deliver faster chips," Bloomberg's Mark Gurman said on Sunday. "I'm told the new models — code-named J714 and J716 — are slated...

Apple recently updated its online store with a new ordering process for Macs, including the MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, and Mac Pro.

There used to be a handful of standard configurations available for each Mac, but now you must configure a Mac entirely from scratch on a feature-by-feature basis. In other words, ordering a new Mac now works much like ordering an...

Apple is planning to launch new MacBook Pro models with M5 Pro and M5 Max chips alongside macOS 26.3, according to Bloomberg's Mark Gurman.

"Apple's faster MacBook Pros are planned for the macOS 26.3 release cycle," wrote Gurman, in his Power On newsletter today.

"I'm told the new models — code-named J714 and J716 — are slated for the macOS 26.3 software cycle, which runs from...