Apple Card Customer Agreement Updated for 'Upcoming' Savings Account Feature

Goldman Sachs this week updated its Apple Card customer agreement to reflect the credit card's upcoming Daily Cash savings account feature, which was expected to launch with iOS 16.1 but appears to have been delayed.

"To enable new ways to use Daily Cash like the upcoming Savings account feature, we are updating the Daily Cash Program section of your Apple Card Customer Agreement," reads an email sent to Apple Card holders this week.

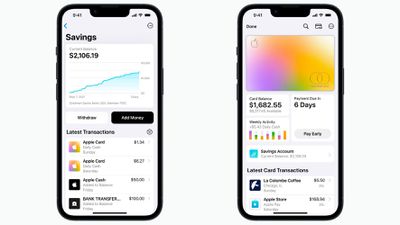

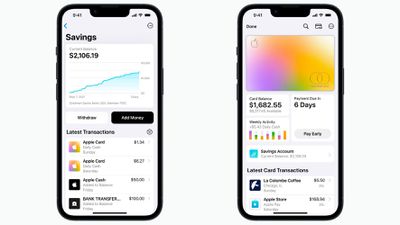

In October, Apple announced that Apple Card users would soon be able to open a new high-yield savings account from Goldman Sachs and have their Daily Cash cashback rewards automatically deposited into it, with no fees, no minimum deposits, and no minimum balance requirements. The account will be managed through the Wallet app on the iPhone.

The savings account was listed in the release notes for the iOS 16.1 Release Candidate, but it did not end up launching with that update. The savings account has not been present in any iOS 16.2 betas, so it's unclear when it will become available, but Goldman Sachs evidently continues to lay the groundwork for the feature's launch.

Once the account is set up, all Daily Cash received from that point on will be automatically deposited into it and start earning interest, unless a user opts to continue having Daily Cash added to their Apple Cash balance. Apple Card provides 2-3% Daily Cash on purchases made with Apple Pay and 1% on purchases made with the physical card.

Launched in 2019, Apple's credit card remains exclusive to the United States. Customers who sign up for an Apple Card and use it to purchase Apple products through December 25 will receive 5% Daily Cash as part of a limited-time promotion.

Popular Stories

Last year, Apple launched CarPlay Ultra, the long-awaited next-generation version of its CarPlay software system for vehicles. Nearly nine months later, CarPlay Ultra is still limited to Aston Martin's latest luxury vehicles, but that should change fairly soon.

In May 2025, Apple said many other vehicle brands planned to offer CarPlay Ultra, including Hyundai, Kia, and Genesis.

In his Powe...

We are still waiting for the iOS 26.3 Release Candidate to come out, so the first iOS 26.4 beta is likely still at least a week or two away. Following beta testing, iOS 26.4 will likely be released to the general public in March or April.

Below, we have recapped known or rumored iOS 26.3 and iOS 26.4 features so far.

iOS 26.3

iPhone to Android Transfer Tool

iOS 26.3 makes it easier...

The calendar has turned to February, and a new report indicates that Apple's next product launch is "imminent," in the form of new MacBook Pro models.

"All signs point to an imminent launch of next-generation MacBook Pros that retain the current form factor but deliver faster chips," Bloomberg's Mark Gurman said on Sunday. "I'm told the new models — code-named J714 and J716 — are slated...

Apple is planning to launch new MacBook Pro models with M5 Pro and M5 Max chips alongside macOS 26.3, according to Bloomberg's Mark Gurman.

"Apple's faster MacBook Pros are planned for the macOS 26.3 release cycle," wrote Gurman, in his Power On newsletter today.

"I'm told the new models — code-named J714 and J716 — are slated for the macOS 26.3 software cycle, which runs from...

In 2022, Apple introduced a new Apple Home architecture that is "more reliable and efficient," and the deadline to upgrade and avoid issues is fast approaching.

In an email this week, Apple gave customers a final reminder to upgrade their Home app by February 10, 2026. Apple says users who do not upgrade may experience issues with accessories and automations, or lose access to their smart...