Goldman Sachs CEO Says Contract With Apple May End Early

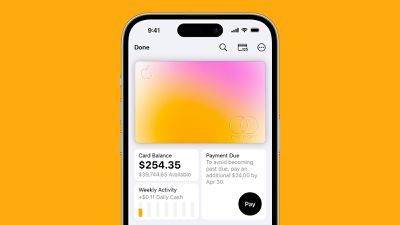

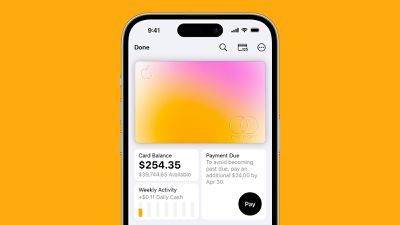

Goldman Sachs CEO David Solomon said that there's "some possibility" the company's Apple Card partnership with Apple could end early, reports Reuters. Goldman Sachs and Apple have a contract that is supposed to last until 2030, but the financial services company wants to get out of consumer banking and out of its deal with Apple.

Back in November 2023, a report from The Wall Street Journal suggested that Apple was aiming to stop working with Goldman Sachs in the next 12 to 15 months. The 12 month mark has already passed, and 15 months is coming up at the end of February, but there hasn't been recent news on the dissolving of the partnership.

Apple partnered with Goldman Sachs for the Apple Card and the Apple Savings account, so Apple needs to find a replacement partner for these services before it can move on from Goldman Sachs.

Goldman Sachs initially approached American Express about taking over the deal, but the Apple Card needs to run on the Mastercard network until 2026 because of a prior contract. Apple held discussions with Synchrony Financial and Capital One, but those talks seem to have ended. As of September 2024, Apple was reportedly in talks with JPMorgan Chase about an Apple Card takeover, but establishing a deal could take months.

Goldman Sachs has faced customer service issues and customer complaints over the Apple Card and Apple Savings account, which ultimately led to an investigation by the U.S. Consumer Financial Protection Bureau. Customers were unhappy with long wait times for disputed Apple Card transactions and issues with transferring money from the Apple Savings account, and Apple is not happy with the poor customer service reputation its financial products have as a result.

Popular Stories

Last year, Apple launched CarPlay Ultra, the long-awaited next-generation version of its CarPlay software system for vehicles. Nearly nine months later, CarPlay Ultra is still limited to Aston Martin's latest luxury vehicles, but that should change fairly soon.

In May 2025, Apple said many other vehicle brands planned to offer CarPlay Ultra, including Hyundai, Kia, and Genesis.

In his Powe...

The calendar has turned to February, and a new report indicates that Apple's next product launch is "imminent," in the form of new MacBook Pro models.

"All signs point to an imminent launch of next-generation MacBook Pros that retain the current form factor but deliver faster chips," Bloomberg's Mark Gurman said on Sunday. "I'm told the new models — code-named J714 and J716 — are slated...

Apple is planning to launch new MacBook Pro models with M5 Pro and M5 Max chips alongside macOS 26.3, according to Bloomberg's Mark Gurman.

"Apple's faster MacBook Pros are planned for the macOS 26.3 release cycle," wrote Gurman, in his Power On newsletter today.

"I'm told the new models — code-named J714 and J716 — are slated for the macOS 26.3 software cycle, which runs from...

We are still waiting for the iOS 26.3 Release Candidate to come out, so the first iOS 26.4 beta is likely still at least a week or two away. Following beta testing, iOS 26.4 will likely be released to the general public in March or April.

Below, we have recapped known or rumored iOS 26.3 and iOS 26.4 features so far.

iOS 26.3

iPhone to Android Transfer Tool

iOS 26.3 makes it easier...

Apple recently updated its online store with a new ordering process for Macs, including the MacBook Air, MacBook Pro, iMac, Mac mini, Mac Studio, and Mac Pro.

There used to be a handful of standard configurations available for each Mac, but now you must configure a Mac entirely from scratch on a feature-by-feature basis. In other words, ordering a new Mac now works much like ordering an...